Major global equity indices are slowly trying to recoup the losses they posted earlier in the year, though some are recovering much better than others. The Nasdaq index has already mended its wounds and managed to break multiple new record-highs lately, propelled higher by a renewed rally in tech stocks, which investors seem to favor in the face of global trade risks despite their “pricey” valuations.

After a bumpy start to the year, major stock indices appear to have slowly gotten their feet back under them and have posted some moderate gains in recent weeks despite a dark cloud of trade uncertainties hanging in the background. It appears markets are sticking with the view that although there may be some turbulence and posturing as the US tries to renegotiate its trading relationship with the rest of the world, the end-game is a broader compromise on trade issues, and not a trade war. This does not go to say the risk of a trade war has faded, but rather that the current landscape is not dire enough to lead investors to materially decrease their exposure to stocks.

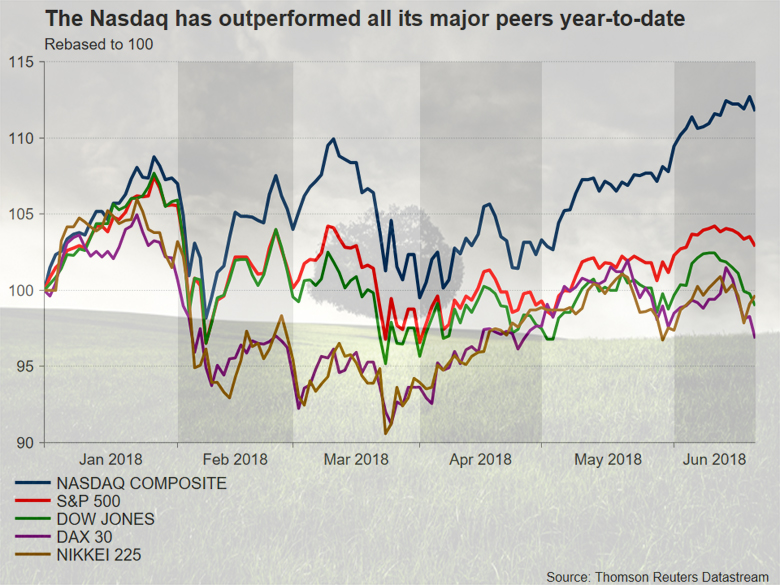

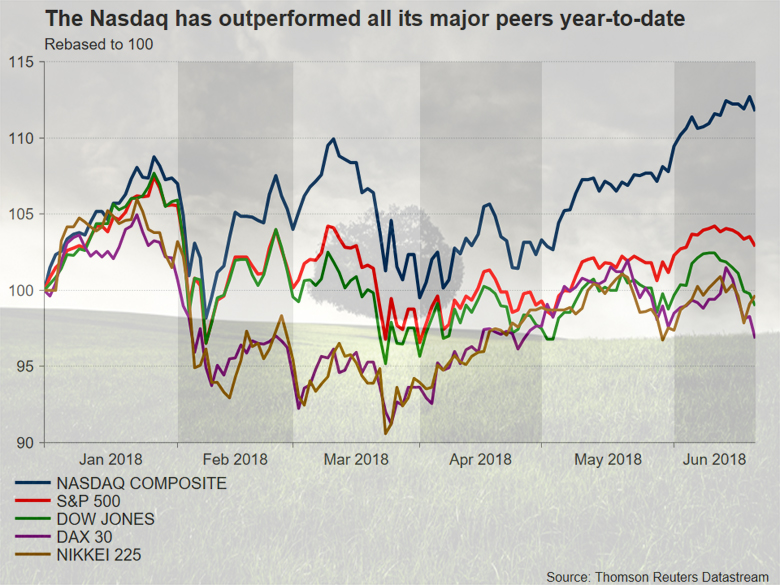

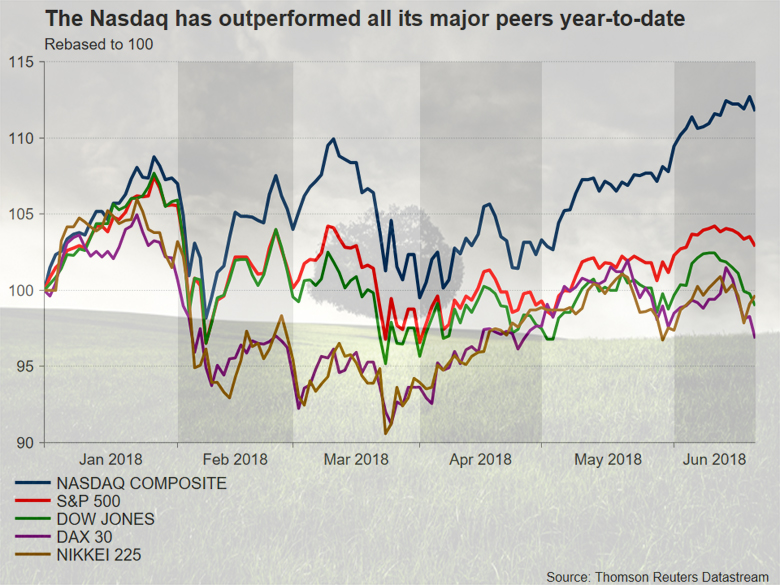

While there has been a broad-based recovery in most indices, some have recovered better than others and specifically, tech stocks have been leading the way higher. The Nasdaq Composite and Nasdaq 100, two indices constituted predominantly by technology firms, managed to recover all their losses from earlier this year and reach fresh all-time highs earlier this month. Year-to-date, the Nasdaq Composite and 100 indices are up by an astounding 11.7% and 12.8% respectively. For comparison, the S&P 500 is up 2.85%, while the Dow is lower by 1.0%. Meanwhile, major Asian and European indices are in even worse shape, with Japan’s Nikkei 225 being down by 1.1% and the German DAX losing 3.1% in the year.

What is most intriguing is that investors are piling into the technology sector even though those stocks are deemed “expensive” by almost all metrics, and despite the looming risk of increased regulation in the sector following data privacy scandals. Looking at a simple valuation metric, the price to earnings (PE) ratio, the Nasdaq 100 stands at the very top of the “overvalued” list with a PE ratio of 27.0. In its simplest form, this ratio is the dollar amount an investor would need to invest in order to receive back one dollar of earnings and hence, the higher it is, the more “expensive” a stock or an index is considered to be. The S&P 500 and the Dow are the next most “pricey” indices, having a PE ratio of 22.1 and 20.4 respectively, while the Nikkei and DAX stand at more reasonable levels of 16.8 and 13.0 respectively.

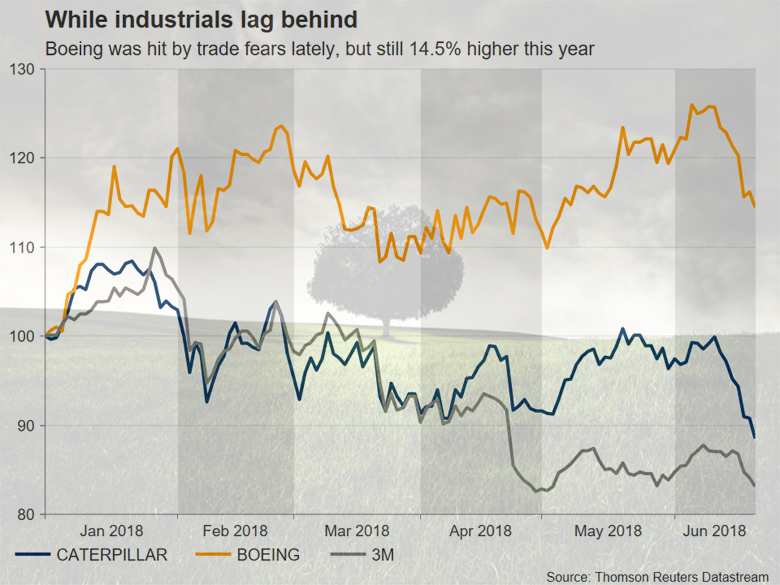

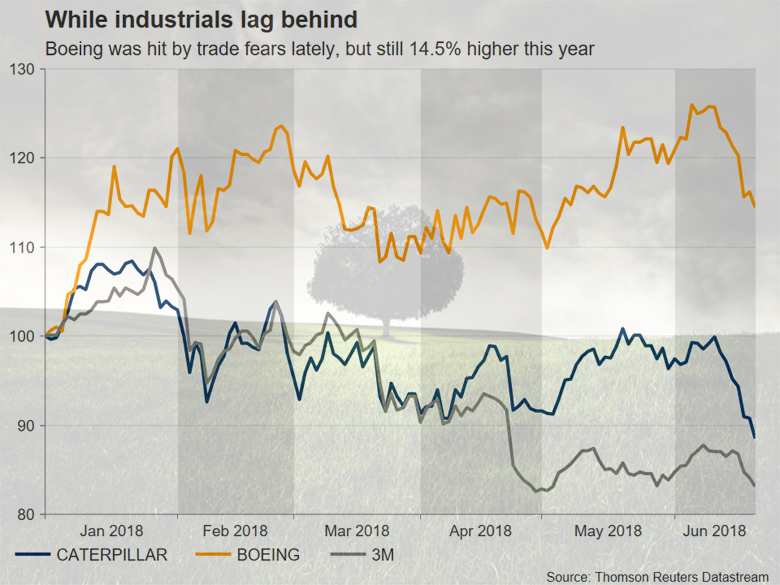

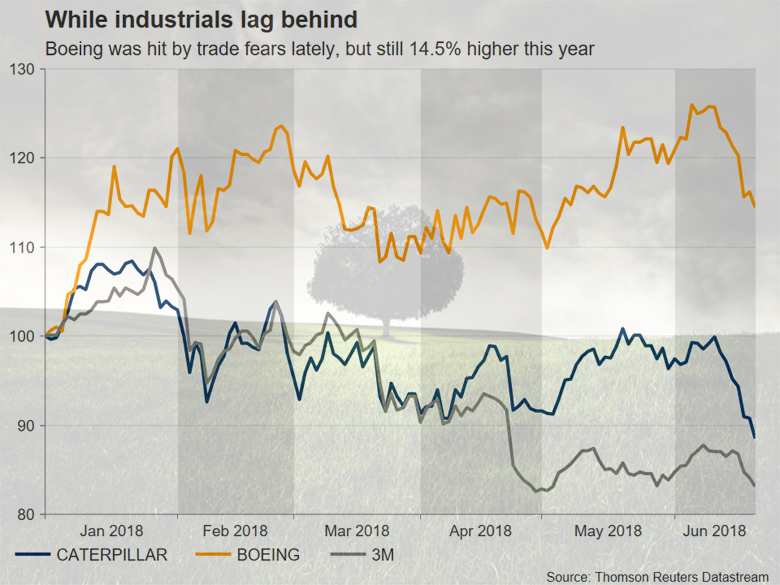

To answer why the technological sphere is doing so much better than the broader market, it may be fruitful to consider the side-effects increased trade frictions may produce. Rising trade barriers between sovereign nations would, all else equal, hurt firms that produce physical goods more than those producing digital ones. Industrial giants like Boeing and Caterpillar would probably see their overseas sales take a significant hit, whereas technological behemoths like Netflix – that do not rely much on physically exporting goods or services – could escape relatively unscathed. Add on top the extremely high growth and scale potential for some technology firms, and one begins to grasp why investors seem to be favoring them so much.

Moving forward, the outlook for equities remains clouded. Arguably the largest risk is that of an “all-out” US-China trade war, which could weigh on stocks in general, diverting funds into safer assets. That said, the Nasdaq has remained surprisingly resilient in the face of such worries, which implies that if trade concerns stay as the dominant market theme, the index could remain the top performer. Note though, that best performer does not always suggest the best positive performance – it could also mean the Nasdaq may fall by less than other indices in case the trade turmoil intensifies. In the same logic, the Dow may be the worst performer out of the US benchmarks in a “trade war” environment. The caveat here, would be something that hits the tech-sector specifically, such as increased regulation for technology firms becoming reality, which would disproportionally weigh on the tech-heavy Nasdaq.

Technically, further advances in the Nasdaq 100 could encounter immediate resistance at the all-time high of 7,310. An upside break would bring the index into uncharted waters, potentially opening the way for the round figure of 7,500. Even higher, the 7,715 hurdle would come into focus, marked by the 161.8% Fibonacci retracement level of the March 13 – April 2 tumble.

On the downside, support to declines may be found near the 7,100 barrier, defined by the June 8 low. Even lower, the 6,852 zone would increasingly attract attention, which is the 61.8% level of the aforementioned retracement. Lower still, buy orders may be found near the 50% Fibonacci retracement, at 6,750.

Комментариев нет:

Отправить комментарий

Примечание. Отправлять комментарии могут только участники этого блога.