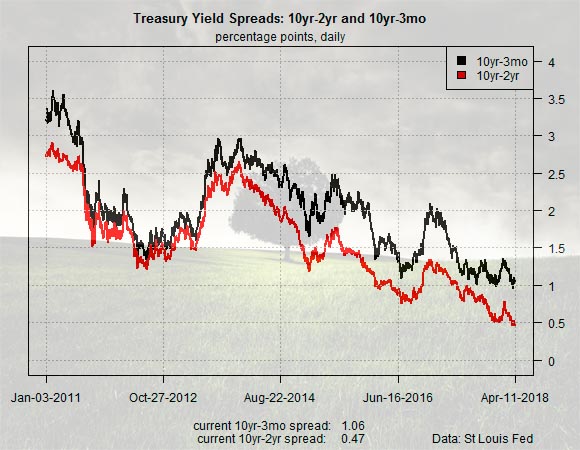

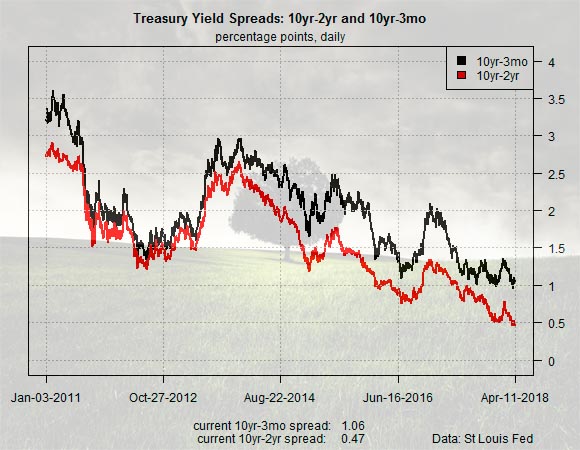

A widely followed measure of the Treasury yield curve has resumed its decline in recent days, dipping to its flattest level in more than a decade. The narrowing between long and short rates is generally considered a signal of weaker economic activity in the future. An inversion of the curve – short rates above long rates – would be a warning that a new US recession was brewing.

For the moment, the Treasury yield spread is still positively sloped. But the difference between the 10-year and 2-year rates edged down to 47 basis points on Wednesday (April 11), based on daily data published by Treasury.gov. That thin spread matches the difference briefly posted late last month and marks the smallest yield gap since late-2007.

Some analysts say that the flatter yield curve reflects rising geopolitical risk rather than a weakening economic trend. “This is mostly geopolitical tension,” said Kim Rupert, managing director of global fixed income at Action Economics. “There are concerns obviously in the Middle East and what might happen. So risks are certainly higher.”

President Trump is reportedly considering military strikes in Syria in the wake of what appears to be a chemical weapons attack by Syrian President Bashar al-Assad against rebel-held areas near Damascus. Trump on Wednesday tweeted that Russia, Syria’s ally, should expect a missile bombing, warning that “You shouldn’t be partners with a Gas Killing Animal who kills his people and enjoys it!”

The odds of coordinated military action in Syria by the West appeared to be on the rise on Thursday, when UK Prime Minister Theresa May summoned ministers to an emergency cabinet meeting to discuss a possible response to a suspected chemical weapons attach by Syria in recent days. A possible joint effort by US, UK, and France is on the table, which raises the possibility of a military confrontation with Russia, an ally of Syria with military forces deployed in the country.

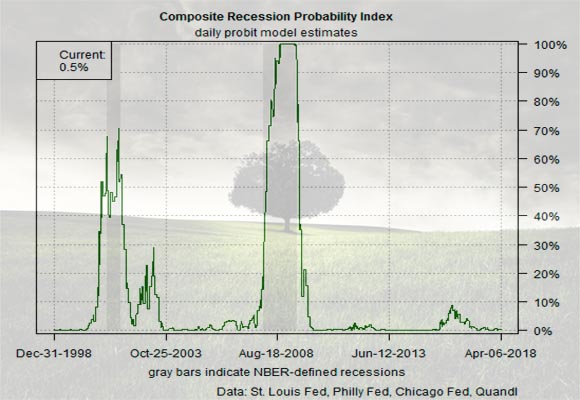

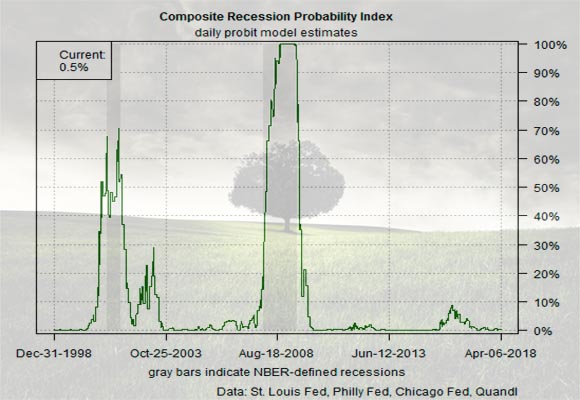

As for the US economy, recent economic data has been largely positive. This week’s edition of The US Business Cycle Risk Report (BCRR) continues to calculate the risk of an NBER-defined recession as virtually nil, based on numbers published through April 6. The probability of a downturn was just 0.5% at last week’s close, based on the Composite Recession Probability Index (CRPI), which aggregates input from several business-cycle benchmarks monitored by BCRR.

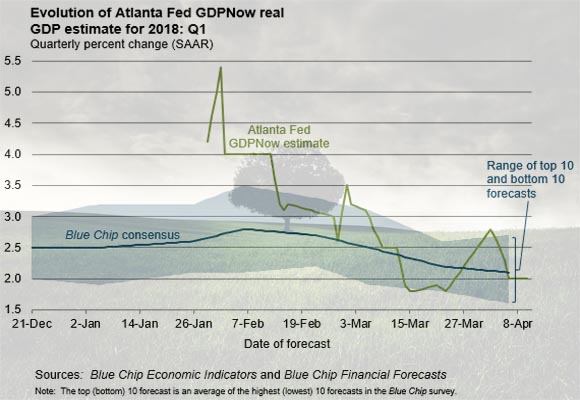

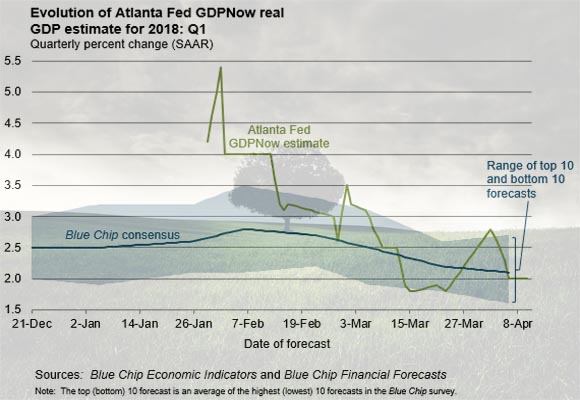

Note, however, that recent estimates of first-quarter GDP growth have weakened. Earlier this week the Q1 estimate for output was cut to 2.0% via the Atlanta Fed’s GDPNow model. That’s still strong enough to sidestep a new recession, although a 2.0% advance, if accurate, would mark the weakest quarterly rise in output in a year.

First-quarter GDP numbers have been weak in recent years, followed by a rebound in subsequent quarters, and so it’s premature to assume the worst from the latest Q1 outlook. Nonetheless, the crowd will be on high alert for any signs of weakness in upcoming economic reports. On that score, keep your eyes on several key updates for March due next week, including the March retail sales on Monday (Apr. 16), followed by housing starts and industrial production on Tuesday (Apr. 17).

For the moment, business-cycle risk remains low. If that analysis is due to change, we may see an early hint of things to come in next week’s releases.