Deutsche Bank’s chief international economist warns that inflation risk is rising, posing the main threat for the investment outlook. Some analysts disagree, although the Treasury market seems to be pricing in this risk.

The implied inflation forecast via the yield spread for the nominal 10-year rate less its inflation-indexed counterpart ticked up to 2.16% on Wednesday (Apr. 18) – the highest since the summer of 2014, based on Treasury.gov’s daily data. That’s still a subdued level compared with the post-recession peak of roughly 2.60%. But the upside bias in recent months suggests that the unusually low inflationary tide may finally be turning.

According to Deutsche Bank’s Torsten Slok, the cat’s already out of the bag. “I think inflation is the mother of all risks here,” the firm’s dismal scientist told CNBC on Tuesday:

We’ve been waiting for inflation, literally, for the last nine years, since the recession ended in 2009. You could ask the question, ‘Well, why now? We didn’t see inflation for the last few years, so what’s different today?’

The answer can be found in a weak U.S. dollar (the dollar index has wallowed around the 90 mark for much of 2018, after a stunning free fall in 2017), an immense fiscal expansion in the last decade pushing the economy toward overheating, a tight labor market, and recent (albeit modest) price pressure in the wake of trade war possibilities and tariff talk, Slok said.

Inflation has firmed up, but there’s still room for debate about the near-term outlook for pricing pressure. Yes, the dollar has weakened over the last year, but the slide follows the sharp 2014-2015 rally and so the US Dollar Index is unchanged relative to its close in 2014.

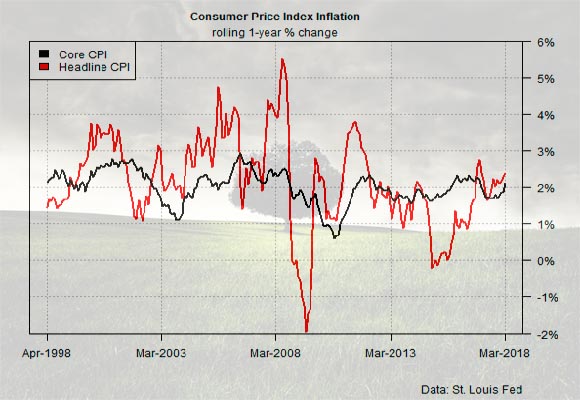

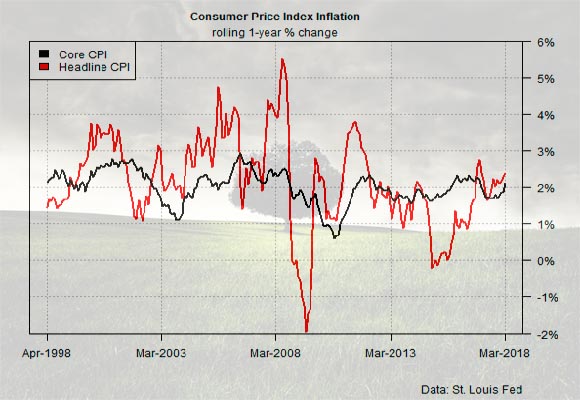

Keep in mind, too, that the official inflation data is relatively contained. But to Slok’s point, the upside trend appears to be gathering momentum, albeit on the margins. Notably, the year-over-year rate of core consumer inflation (excluding food and energy) ticked up to 2.1% in March, the highest in more than a year.

Meantime, the recent rally in commodities prices suggests that headline inflation will continue to heat up. Reuters today reports:

Talk that Saudi Arabia has its sights on $80-$100 a barrel oil again ignited a fierce rally in commodities and resource stocks on Thursday, though the potential boost to inflation globally put some pressure on fixed-income assets.

Perhaps the determining factor is US economic activity in the spring. The upcoming Q1 GDP report, by comparison, is expected to reflect a slowdown. Growth is on track to decelerate to 2.1%, according the average estimate via The Wall Street Journal’s economic survey for April — down from 2.9% in the previous quarter.

The question is whether a cooling economy will keep a lid on inflation in the months ahead? The alternative scenario, following the path of the last two years, is a Q1 soft patch followed by a rebound later in the year.

Whatever happens, Q2 looks set to be a critical quarter for inflation. It’s still premature to assume that pricing pressure is due to heat up beyond current levels, but for the moment the Treasury market is considering the possibility.

Wealth manager Gluskin Sheff's economist David Rosenberg is on board with that risk analysis. He advises that there’s an 80% probability that the core consumer price index’s current 2.1% annual pace will rise above 2.5% in the near term and a 50% chance that we’ll see it above 3.0%.